|

How to interpret Valuation scatter

Briefly

|

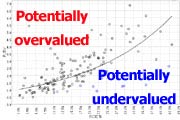

Scatter graphs illustrate graphically

what kind of valuations companies have relative

to their growth or profitability prospects.

Companies are plotted in the graph so that the

potentially undervalued companies are normally below

the trendline and overvalued companies are above

the trendline. The most interesting companies are

also presented with blue font, both in the graph

as well as in the table below.

|

Click

picture to enlarge image |

So the same companies are also shown in the table below

and also sorted so that the most lucrative (undervalued)

companies are on the top.

Acid test with history parameters

Notice that there are also graphs/tables where the parameters

are based on historical figures: e.g. P/E 2002 (Y-axis)

is compared with EPS growth 2002-2004. The sole purpose

of this kind comparisons is to show and prove the importance

of this kind of review. As you might see in this kind

of graphs, "the most lucrative companies", i.e.

the coloured companies, are often also exactly those companies

that have outperformed the market significantly in the

past.

However, you must also bear in mind that this does still

not prove that the future oriented scatter graphs and

tables (e.g. scatter with P/E 2005 and EPS growth 2004-2006)

would be as succesfull as the historical graphs: in the

future graphs the explaining parameters (EPS growth in

this example) are based on future

analyst estimates and as we all know they are not

always too reliable...

Valuation at Y-axis, explanation at X-axis

The scatter -graphs at Valuatum Platform are always constructed

according the following pattern:

Y-axis - valuation parameter

Y-axis represents always the valuation-axis/valuation

parameter: the higher the company is in Y-axis, the more

expensive is its valuation (e.g. according to P/E, P/BV,

EV/EBIT). However, in some cases high valuation in Y-axis

is more than compensated with X-axis parameter so e.g.

estimated growth or high profitability and thus at the

end the valuation of the company might even be lucrative

(so the company might still be under the trend-line).

X-axis - explanatory parameter

The X-axis represents the explanatory parameter: it kind

of explains why the valuation is high. E.g. one scatter-graph

has P/E as Y-axis and future EPS growth as X-axis. This

is because high P/E normally means that markets expect

that the EPS of that company is growing in the future.

Trendline reveals correlation

Normally the whole population of companies are placed

in the graph so that, on average, the companies with higher

valuation multiples have also higher growth or other explanatory

parameters. Therefore the trendline, drawn based on all

companies, also normally slopes upwards.

However, there seems to be some cases where the trendline

is flat or even very slightly sloping downwards and thus

suggesting that there is no real correlation between some

valuation multiple and corresponding explaining parameter.

Of course this might reveal that perhaps the parameters

on Y-axis and X-axis are not very perfect match. I.e.

the explaining parameter at X-axis is not very good in

explaining the valuation parameter in Y-axis.

If we talk about future estimates it might also be possible

that the analyst estimates are unreliable. And the last

explanation is that "market just has not found these

companies". This might appear to be unsound assumption

which underestimates the effectiveness of the market in

valuing companies correctly, but please be open-minded

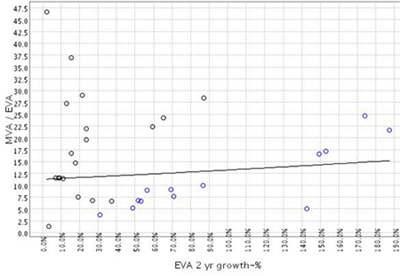

and look e.g. the graph/table of MVA/EVA 2002 and EVA

growth 2002-2004: the graphs shows the following companies

as the top-15 companies and thus suggests that they were

the ones that had lucrative valuation back in 2002:

...and as we all know these 15 companies have almost

all turned out to be very good performers during 2002-2004.

Still the correlation between these parameters has not

been too strong as you can see from the corresponding

graph and its trendline slope below:

The weak correlation e.g. in this graph above tells us

that the market has not been able to forecast the good

performance (EVA growth in this example) of these companies

and thus it has undervalued those 15 companies back in

2002. Thus, in our opinion, these figures and graphs reveal

that there are a lot of opportunities within the market

to plot lucratively priced companies with fundamental

analysis. Again, we would like to remind users that the

useful, future oriented scatter graphs are only

as good as the estimates underneath them.

Scatter graph parameters

We have scatte graphs (pages) constructed from following

parameters:

|

Y-axis (valuation parameter)

|

X-axis (explaining parameter)

|

|

P/E

|

EPS growth

|

|

P/BV

|

ROE-%

|

|

EV/EBIT

|

EBIT growth

|

|

MVA/EVA

|

EVA growth

|

In each of these cases the parameter at X-axis should

be theoretically quite good in explaining the valuation

parameter at Y-axis. If you would happen to have in mind

some parameters that would still be suitable for scatter

graphs and tables, please

inform us about them and we will put also them on

our system.

Warning - valuation scatter only as good as forecasts

One should bare in mind that all the X-axis parameters

that present future values (future growth, future profitability

etc.) are only as good as the underlying analysts estimates.

And as we all know, analyst estimates are almost never

exactly right. Therefore, before making any hasty conclusions

based on what companies seem to be undervalued according

to XY-scatter graphs, one should always click the corresponding

company name in the table and look what kind of estimates

the analyst has used and what kind of arguments the analyst

has behind his/her estimates.

You can find more information about valuation theory

with e.g. "P/BV - ROE-%" and "MVA/EVA -

EVA growth" scatters from the EVA

valuation tutorial. The presentation reveals very

illustratively how these parameters interact with each

other and why.

|