Rewarding of the freelance analysts

General things about monetary rewarding

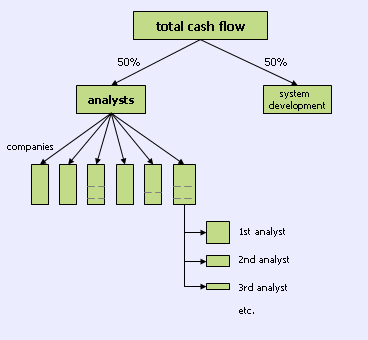

Revenue sharing => 50% of revenues to analysts

The monetary rewarding of the freelance analysts is

based on revenue sharing. Half of the revenues generated

by the sales of the analysis by the freelance analysts

are paid to the analysts.

|

Allocation to companies

Allocation to analysts

|

(Actually the analysts get 60% and the share of system

development is 40% as the current revenue sharing scheme

is: 50% to analysts, 10%

to coaching analysts and 40% to the system.)

Allocation to different companies

Some customers buy only analysis of some companies...

Some of our customers buy only analysis for certain

companies only. Therefore some companies are more valueable

analysis targets than other companies. So the revenue

for company X might be 200 EUR/month and revenue for company

Y is only 20 EUR/month as some of our customers buy only

analysis of company X but not analysis of company Y.

But some customers buy it all...

When we get revenues for customers who buy all of

our analysis, then the revenues from those customers are

allocated equally to different companies. So every company

gets equal share of these revenues no matter whether the

company is big or a small. This perhaps peculiar-sounding

allocation principle is well-grounded: big companies are

more followed and therefore the analysis of smaller companies

is relatively more valuable, although not so many investors

are interested or hold shares in small companies.

Later on the system will gather information about which

company analysis is most frequently used by clients and

thereby the revenue allocation between different companies

is likely to change so that revenues are allocated based

on usage between different followed companies. We believe

that even in this allocation the small companies will

cope relatively well: big blue chip companies are priced

quite effectively and followed by hundreds of analysts,

therefore they offer relatively much weaker possibilities

for investors to find undervalued shares and therefore

smaller companies are interesting investment targets.

Allocation to different analysts

There are three basic rules as the revenues are allocated

to individual analysts:

- The majority of revenues is allocated to best analysts

- Original

analyst gets his/her share for certain period of

time

- Analysts with very poor points are left out of

revenue allocation

Below each of these rules are discussed in detail.

Allocation to different analysts 1/3: best analysts

get most

The revenues for one company are allocated to different

analysts, who are following that same company, based on

their relative position: 1st analyst gets twice as much

as 2nd analyst, and 2nd analyst twice as much as 3rd analyst

and so on.

Reasons behind this kind of allocation

and possible changes to this scheme later on

Customers of course appreciate the

fact that there are analysis from different people and

thus there are different opinions from the same company

(and also good quality control as analysts are good

to notice each others' mistakes...). Therefore we all

have an interest to reward also other analysts than

#1 at the same time as we have an interest to compensate

analysis quality and foster healthy competition among

the analysts. Therefore, if it seems in the future that

2nd, 3rd etc. analysts get relatively too little revenues

to be motivated, we might change the allocation principles.

One possible allocation could be that

#1 gets still most but not twice as much as 2nd analyst.

And perhaps the allocation between 2nd-5th analysts

would be more flat than currently. And perhaps 4th

analyst and so on would not get anything, which would

ensure that the the revenues would still not leak

too much from good analysts to not-so-good analyst

even though the allocation would be a bit more flat

than currently.

Another possible allocation change

is that revenues within one company would be allocated

based on analysis rankings: if the #1 and #2 analysts

are very close to each other in analysis rankings,

then they would get also more flat revenue allocation

than currently. If they have very big differences

in analyst rankings (#1 analyst would e.g. have much

more precise earnings estimates) then the revenue

allocation could favour #1 analyst even more than

currently.

All these things will however depend

on how analysts themselves react on these compensation

schemes and how many and how good analysts the system

attracts for each company. We have insentive to keep

all the good analysts motivated and get as many different

opinions as customers see necessary. Of course the analysts'

own opinion will be very important so before any changes

these things will be discussed with you at the analyst

forum dedicated to these issues.

Allocation to different analysts 2/3: The incentive

of Original analyst

The first analyst that puts a certain company into the

database with decent comments and provides his/her excel-model

to other analyst is rewarded with an "Original analyst"

-status. It means revenues for a longer period of time

from that particular company even though he/she would

not be the #1 or even #2 analyst of that company. The

aim is to foster and compensate those analysts that bring

the companies into the database for the first time. Read

more about "Incentive

of original analyst".

Allocation to different analysts 3/3: Minimum points

requirement

The revenues are not allocated to those analysts that

do not provide decent comments to their estimates, decent

background infromation or have some very peculiar features

with their estimates AND do not correct these things even

though admin-persons or customers point them out. Currently

this kind of analysis are those that have below 0.5 admin

points (less than 14% of all companies). Later on we will

probably establish some kind of minimum customer points

or automated points level to mark off this kind of analysis.

Information and agreement

Information about customers and revenues

The analysts will receive more detailed information about

the customers and revenues after they have started providing

analysis. This will cover also the future customers i.e.

the customers this research is offered and how sales process

develops in different targets. This information will however

be available only for analysts that have provided decent

analysis for the system - we cannot of course give this

information to people who register as an analyst but never

produce any research. That would be same as to put is

publicly available for anyone.

Agreement with the analysts

In registration process each analyst will also accept

a written agreement which confirms the legal rights of

the analyst to her analysis and to half of the revenues

generated with it. Analysts do not have any obligations

to the analysing: they can stop participating in this

research at any phase.

Monetary rewarding

hopefully not the only motivation

Monetary rewarding small in the beginning

We have started the freelance analysis in Finland and

first it took about half of year when we only produced

analysis but could not sell it to anyone - so analysts

did not receive any revenues. Thereafter we have gained

many customers: i.e. banks, stockbrokers, investors etc.

who pay for the research. However, all of these customers

have started very cautiously and thus the cash-flows for

analysts have not been very big - actually currently (in

summer 2006) the cash-flow for our best analysts have

been around 500 EUR /month so currently nobody can think

this as their main job. However, the cash-flows to analysts

have increased in each single month during this year as

we have received new customers. And this kind of development

is likely to continue so the revenues are continuously

growing.

About foreign markets:

After the concept is flying well in Finland, we will

also apply this to foreign markets, starting from Scandinavia

(Sweden...), Central-Europe (Germany...) etc. Thereby

analysts must remember that if we would be about to start

the analysis in your geographical location, then in the

beginning the monetary rewarding will not be huge - in

fact, it is likely to be zero for the first months as

we probably do not yet have customers at your geographical

region. In this period the analysis is given out free

as long as it takes to get it enough well-known in the

market. In Finland it took us 5 months before we got first

paying customers. However, the data was given to big group

of customers and very wide audience (hundreds of users

each day) already after 2 months after the start (as free

trials). We however have reason to believe that in next

markets like in Sweden, Poland etc. the time-frame will

not be so big as we already have customers that are interested

in that research. We might even have some customers ready

as we start in e.g. Swedish market.

Even after we have paying customers and stop delivering

the research for free, some kind of restricted version

of the analysis (limited number of companies and sections)

is given out free (e.g. though online financial newspapers)

so that we have something to offer also to those investors

that are not yet willing to pay the full price of the

service.

Learning by doing with professional

tools and guidance

One more important motivation than the monetary reward

could be the unique possibility to learn how to do professional

investment analysis using professional tools and under

professional supervision and support. You will get feedback

and guidance in many formats and you will be able to enhance

your analysis based on that.

You would also get indirect but very interesting and

quite objective feedback on your work through the estimate

accuracy control and through comparing your analysis with

other analysts or their points. There is a good portion

of healthy competition with other analysts colleagues

which also makes the work more fun and rewarding. For

good analysts it is also very delightful to compare the

estimate accuracy etc. to the corresponding figures to

professional sell-side analyst (consensus estimates)

- a thing that would be very nice to bring up if you

apply for a job within the investing industry later on:

if you can say that you have consistently e.g. over couple

of quarters estimated better than consensus estimates,

then it really interests employers in any financial branch.

Furthermore, our professional tools ensure that you do

only minimum share of tinkering with modelling details

and routines and that you thus can focus on most essential

things in analysis. This ensures that your time spent

with these issues yield maximal learning.

Growing your personal market

value

A very important benefit for younger people would perhaps

be the possibility to grow your personal market value.

I.e. build up a name as a professional analyst as many

institutional investors use the analysis. This kind of

effect will be there almost immediately as the analysis

surely gets to appreciated financial www-sites (online-versions

of top financial newspapers from your region) as soon

as the coverage is good enough. In Finland this happened

in less than 2 months.

Furthermore, the institutional investors in each geographical

region will be contacted directly and offered free trial

periods. In Finland there is a restricted version available

for anyone through the front page of the online version

of financial newspapers like Taloussanomat (www.taloussanomat.fi)

and Arvopaperi (www.arvopaperi.fi

) as well as through other sources like Pörssisäätiö,

through some big customers who reach tens of thousands

of investors like eQ

Online etc..

It is hard to imagine a better recruiting channel for

institutional investors and other investment professionals

than our system where they can very transparently see

what kind of estimates, presumptions and comments the

analysts make and what analysts seem to stand out as the

best ones. Analysts' comments about the financial estimates,

competitive situation and the industry future bring out

the knowledge and understanding of the business in question.

Also the management (general management, financial management

and corporate planning) of the target companies are very

interested in the analysis and appreciate the understanding

of the logic of business in their industry.

Thus, it is no wonder that so far (until 18th February

2005) in Finland - so after 9 months of freelance analysis

- six of our freelance analysts has already been recruited

as analysts by stockbrokers or corporate finance units.

Furthermore some others (that we know of) have been asked

to work for as an analyst or in other corresponding position

within different companies. It is also no wonder that

those freelance analysts are the ones with the best

Valuatum admin points => they represent the best

freelance analysts and they are very easily noticed by

financial employers. Still this is quite a remarkable

percentage out of about 40 freelance analysts currently

working in Finland - especially as many of them are very

happy with their current positions and thus have no intentions

whatsoever to change their current employers.

And of course this is a very good way for anyone to find

out whether it suits he or she personally to be an equity

analyst: whether he/she likes to do this kind of job and

how easy it is to develop in this profession.

Easy yet very sophisticated tools for active investors

Some investors (both institutional and some retail) are

already now following some of their current or potential

investment target with some kind of fundamental models

where they at least calculate different kind of ratios

and test different estimates. For those investors the

freelance analysis offers very good yet easy-to-use tools

for analysis, which make them save time and effort (including

the prefilling etc.). The first beneficiary of the analysis

will of course be the analyst him-/herself.

Future outlook

Open source analysis in the short-term?

As indicated in the previous chapters in the beginning

this is probably a kind of "open-source" equity

research: analysts put efforts to this just for fun or

for merit - not for money. Exactly like the thousands

of Linux and other open source software developers. Some

of them get well known and appreciated and get their rewards

thatway (as interesting job offers etc.). Or system is

of course fundamentally quite different as analysts are

entitled to revenues rights from the beginning, and also

their best monetary rewards might also come from this

same system unlike with open source developers.

Competitive earnings in the long-term

In the long-run we expect that good analysts get decent

revenues and they might also do this as full-time work.

The system ensures that analysts get fair share (50%)

of the results they are able to generate. The system is

also very fair or even severe so that within each company

the best analyst will surely be recognized in the long

run (e.g. estimate accuracy measured, shown in graphs

and credited in analyst rank) and thus he or she will

earn correspondingly.

We have already seen that this kind of system is what

investors wish to have and that the value of the system

grows along with the amount of research (companies followed).

As equity analysts in general can be a great value added

for investors, it is understandable that equity research

market is huge business. If our very sophisticated system

and good analysis produced by our analysts can take a

decent share of that business in the long run, then we

can also expect very good revenues and also very competitive

especially for the best analysts.

Back to freelance analysis intro

Proceed to freelance analysis

start

Information about receiving

the collected income

|