|

You have reached an old page that is no longer updated in this location.

You will be redirected to a new page automatically.

Please update your bookmarks!

If the redirect doesn't work for some reason,

please continue to the new

location.

Freelance Analysis Step-By-Step Guide -

How to make analysis with prefilled Valuatum Excel model

Note! This document describes the process of doing

analysis in practice. If you are interested in freelance

analysis in general, please see

Freelance introduction

Freelance introduction

Here below are listed the individual steps you need to

do in producing research with our system.

- Registration 3 minutes

- Choosing a company (company reservation)

2 minutes

- Find Information about companies for

the analysis 3 minutes

- Different tools to save the analysis

1 minute

- Basics of the Excel model 3

minutes

- DB2Excel - Copy

company data from database

(prefilled excel model)

- Doing estimates in practise

25 minutes

- Long-term estimates 5 minutes

- Analysis is ready - How to put

it into Database 3

minutes

- Justifying your estimates

15 minutes

- Filling out company background

info 2 minutes

- Analysis is ready for the public

eye - Ask for feedback 3 minutes

- Continuous analysis (updating

numbers and comments)

- Year change and model updating

Numbers behind each step are rough estimates how much

each step would take your time if you are efficient and

do not pump into any problems. First time users, especially

if they have not done analysis before, are likely to use

much more time especially during steps 2-5 and 8.

1. Registration

The first thing to do on the way in becoming a freelance

analyst is filling the registration form and uploading

your CV. After you have registered, you will be forwarded

to the analyst main page which will be the starting point

of your future analyst career.

Click

here to register as an analyst

2. Choosing a company (company reservation)

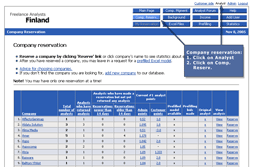

|

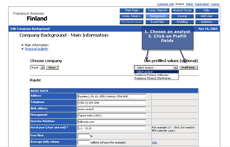

Next you have to choose a company on which to do

analysis. This is done by using the company reservation

system accessible from the analyst main page (see

picture 2.1). Here

are some advice in choosing companies.

It is possible for an analyst to analyse more than

one company at a time, but further companies can

be reserved only when the analysis on the first

company reservation is ready and in the database

(of course you can also cancel your reservation

and reserve another company). When you have reserved

a company, you will be provided with the Excel model

needed for doing the analysis.

|

Picture 2.1 - Click picture for

full-size.

|

3. Find information about companies

Where to get information about companies?

The easiest and often also the best source of information

is company stock exchange releases. E.g., from all

Finnish companies, you can find all the releases

at Helsinki

stock exchange www-site.

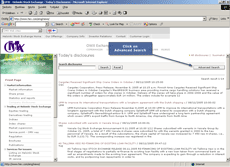

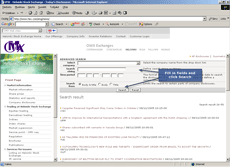

- Click advanced search and you can search

database easily by companies. See pictures 3.1

and 3.2.

- Open the company's latest financial report

to know what happened in the last period.

- Read also the Outlook for future.

More

information sources.

|

Picture 3.1 - Click picture for

full-size.

Picture 3.2 - Click picture for

full-size.

|

At this point you probably rush to read the stock exchange

releases from the company you have selected to analyse.

And as you read those releases, you kind of start analysing

the company. Therefore we would like to say a few words

about what is important in the analysis, even though these

things are originally written for instructions for the

phase where you start to change the estimates (phase 6).

So we recommend that you read this text already now before

reading the company disclosures:

Focus

on these things in your analysis

Future estimates are probably the

most important thing in analysis, and you should

really put effort in them. First you should concentrate

in the short-term estimates. The basis for the short-term

estimates is the current situation in the company: the

management guidance, cyclical situation, as well as

analyst's own assessment of the competitive situation

and market. You should also try to find out what other

market participants and research providers think of

the company's future: The

difference between your view and the consensus is crucial

for the pricing of the company and you should always

comment on it - if only there are consensus easily

available for your target company. In Valuatum Platform

there usually is consensus available for 3/4 of all

companies, so you have about 75% change to find consensus

estimates really easily.

It is also highly recommended that you start writing

down all the observations about estimates and reasons

behind them. Just open notepad or MS Word (or some similar

program) and write down important things. You can use

these comments later when you are writing your forum

messages, thus, they will definitely not be a waste

of time. We also strongly recommend that you

read instructions

about forum comments and commenting your estimates

before you determine what your short-term estimates

are. Reading first forum comment instructions and knowing

what kind of notes you should do, it is easier to make

useful notes while contemplating your estimates

Management guidance. Management has, or at least

should have, the best view how things are going and

developing in the company. This does not mean management

guidance would always be accurate. However, if you decide

to go against guidance in your own estimates, you should

have very good reasons to do so, and you should also

tell them to others (in forum comments). You can also

check how reliable management guidance has been in the

past. If guidance has been too optimistic (or too pessimistic)

in the past, you should take this into account (and

let others know about it - they can't read your mind).

Remember also that the company's situation changes all

the time; e.g. if the guidance made by the management

is not going to be fulfilled, the management has to

publish this information without delays.

Order book and its development. If the company

operates in a field where order book is relevant and,

thus, it reports it, then order book and its development

can help you to form a picture how things are developing

in your company. The importance of order book is very

different among companies; however, it is still worth

studying if it is available. See how order book has

developed and compare that with net sales. How have

they correlated in the past? And what is more important,

what can you expect to happen to net sales in the future

quarters based on current reported order book?

In addition, one more small thing with which you can

easily spoil otherwise good analysis: remember also

to take into account the

seasonal variation of sales and ebit.

4. Different tools to save the analysis

There are three tools to save the analysis:

- Excel model (the most comprehensive

one)

- Browser model

(quick and easy to use)

- ValuModels

(somewhere between those two, requires Java Runtime

Enviroment)

For a comprehensive analysis, we recommend you to

use the Excel model for which

you find instructions below.

The browser model

may be useful in some special occasions. First of all

you can use it from any computer with internet connection:

e.g. in internet cafe anywhere in the world without any

access to Microsoft Excel. With browser model is might

also be easy to start analysis for the first time. Then

there has be a good enough analysis from the chosen company

already in the database as you can not (at least currently)

fill in all the historical parameters with browser model.

ValuModels

is somewhere between Excel Model and Browser model: it

is more comprehensive than browser model and more easy

to use than Excel model as everything is in the same window

and quarter and divisional level can easily be accessed

in "tree-structure". Furthermore you can change

any level in sales and ebit (group, division, quarter

and any of their combinations) as the model has formulas

to each direction: from bottom up as well as top-down

allocation. However, ValuModels has also its weaknesses:

it runs on java (requires Java Runtime Environment in

your computer) and it is sometimes unstable and might

fall dawn and then you lose your numbers (you must save

your work often if you use ValuModels to change your estimates).

5. Basics of the Excel model

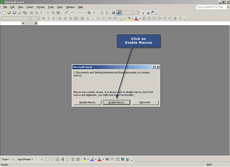

Opening the Excel model

Open your Excel model just like any other Excel

workbook. Model includes some macros. Excel might

warn you about them, but when you just click "enable

macros" the model should open without problems

(see picture 5.1).

In some cases you might also pump into "Circular

reference" -problem announcement when opening

the Excel model. Put iteration on to avoid that.

More

info behind this link.

|

Picture 5.1 - Click picture for

full-size.

|

DB2Excel (from DataBase To

Exce) is a tool that enables you to copy

all the historical (and estimate) data from any

other company/analyst from Valuatum database to

your Excel model. So it enables you to start

with prefilled model and you should absolutely

use it as there is no sense that you would

input all the historical data that has been inputted

already by some other analyst. Click

here for more detailed instructions about how

to use DB2Excel.

Starting WITHOUT prefilled

numbers

Some more experienced analysts might also need

our Empty Excel-Model

Step-By-Step Guide. It is especially needed

if you cannot obtain prefilled model but instead

you have to input even all the historical numbers

by yourself. Empty

Excel-Model Step-By-Step Guide is also more

detailed than this document so also other analysts

might find help for some problematic situations

from there.

|

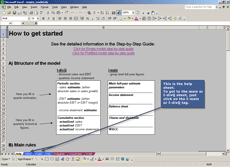

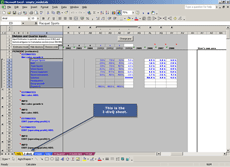

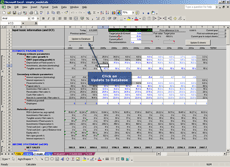

What sheets are used?

Once you have opened the Excel model, you should

see something like picture 5.2 in front of you.

This is the help sheet of the model. To get to the

other sheets, click on the sheet names on the lower

bar (see picture 5.2). Sheets that actually are

important to you right now are I-main (picture

5.3) and I-divQ (picture 5.4) (I stands for

input).

|

Picture 5.2 - Click picture for

full-size.

Picture 5.3 - Click picture for

full-size.

Picture 5.4 - Click picture for

full-size.

|

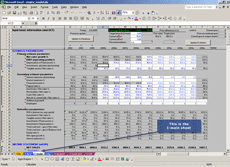

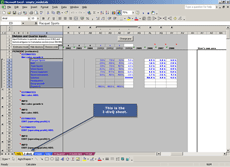

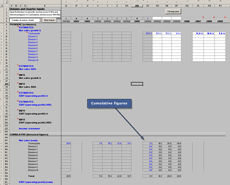

Information on the sheets

I-divQ sheet (see picture 5.5) has income

statement figures in divisional and quarter levels

from few years of history and few years of estimates.

All the other information can be found in

I-main sheet (see picture 5.6). There

you can find all balance sheet figures, share information,

long-term estimates (both income statement and balance

sheet), and everything else needed.

|

Picture 5.5 - Click picture for full-size. |

Output sheets

You can also browse information at output sheets

like O-quarter and O-overview, but

remember that you are not allowed to change anything

on output sheets. All changes to figures must

be done at input-sheets: I-divQ and I-main.

|

Picture 5.6 - Click picture for

full-size.

|

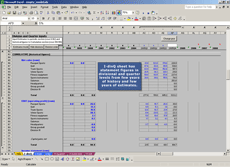

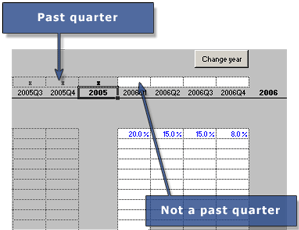

Past figures at I-divQ sheet

All the quarters where the numbers have already

been reported has to marked as passed (with "x"

in row 4 as shown in the picture 5.7). With past

quarters the actual figures are inputted in cumulative

section beginning from row 147.

So check the row 4 at I-DivQ-sheet and see whether

all the historical quarters are marked as passed

quarters (Picture 5.7).

E.g. if the interim report for Q1 has already been

published, the column for Q1 estimate figures should

be marked as passed with an x mark and the background

color should be gray.

If the interim report of the first quarter in white

- has not been published, you can continue to

the next chapter.

- has been published, do the following:

- Change the quarter (or year).

See instructions.

- Update cumulative figures (Picture 5.8)

|

Picture 5.7 - Click picture for

full-size.

Picture 5.8 - Click picture for full-size.

|

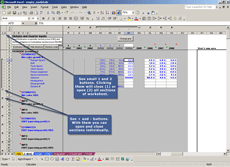

Hiding and unhiding rows

You can open and close different parts of workbook

by clicking + and - signs on the left side and on

the upside (see picture 5.9) in the I-divQ sheet.

You can also press 1 or 2 in the left up corner.

1 will close all sections and 2 will open all of

them. It is handy to keep all the other information

out of sight that you are not processing; thus,

it helps you a lot if you start to use the Excel-file

with these +/- signs.

|

Picture 5.9 - Click picture for full-size. |

Important rules

You are allowed to

Enter and change values in the (input) cells that

are with blue font color.

Attention!

You are NOT allowed to

- change any formulas in the output cells

that are

in black font

- remove or add any rows or columns (you

can however hide them)

If you need to do own calculations that need space,

then you can also add own sheets and make links

from them to the input cells. But never add rows

to current sheets of Valuatum Excel model like I-main

and I-divQ.

So, the

key rule is that change only blue input cells,

not black output cells.

Enter all absolute numbers in millions (of euro

for example).

More information about Valuatum Excel model can

be found from Excel

manual and Empty

Excel model step-by-Step tour (Empty

Excel model Step-By-Step tour is meant for analysts

who do not get prefilled Excel model but have to

start with empty Excel model as no-one else has

followed the company before that they are going

to follow. That help document is, however, much

more detailed than this document and thus also prefilled

model users might get some help from it.)

|

6. Doing estimates in practise

Do you already know what is most important in doing short-term

estimates? If you do, then please proceed, but if you

do not please get back to chapter 3 where the most

important things in analysis were described.

Read the latest company result announcement and/or annual

report once more and then change the estimates as you

think they should be changed:

What figures to estimate

The most important figures to estimate are

- EBIT (operating profit)

- Net sales

Where to input the estimates

The near-future estimates are done in the I-divQ

sheet. There you will find the divisional information

by quarters (see picture 6.1).

Input estimates in the white cells with blue font.

Making changes to the model

While thinking your estimates you will get a lot

of help from division

graphs -macro. Especially seasonal

variation is easy to take into account with

the graphs.

The future estimates can be done with absolute

or relative numbers. You can put absolute figure

of net sales to ESTIMATES Net sales ABS and relative

net sales growth %. Let's say, you believe that

your company's one division will have a rise of

15 % in net sales in Q4 of the current year (see

picture 6.2). Just put 15 % to Q4 of that division.

You can also input your estimates as absolute figures.

Thus, if you believe that net sales will be 150

million euros in Q4 of the current year, simple

put the number 150 to Q4 sector of this division.

However, you need to remember one thing:

Absolute figures dominate the relative ones.

This means that if you, or someone else, has

filled in both an absolute figure (150 millions

in this example) and a percentage (15%), then the

percentage becomes unrelevant, and it no longer

matters what in the growth % (15 % in this example)

is as the absolute figure (150 mEUR) dominates.

Remember: all

changes must be done with figures in blue font.

Do not change, e.g., the info fields in black font.

INFO fields

You will also find INFO fields on i-DivQ

-sheet. They are only informative as they gather

different estimate paths together: you can change

an estimate either in absolute terms or with percentages

and the quarter in question might already be in

the past and then the real historical values are

inputted in the cumulative section. Therefore it

is practical that we have info fields where the

real and uninterrupted series of both past figures

and estimates is shown. And that is why we have

INFO fields. You must not input anything to INFO-fields

(as you see they are in black font) so if you would

like to change estimates, you use periodic estimate

fields (above the info fields) and if you have to

change historical figures, then change the cumulative

figures on the bottom of the sheet.

Make other estimates

In the similar way you can make your own estimates

about EBIT of the company. There is also a possibilty

to use absolute figures or relative ones (EBIT%).

After EBIT move along to the income statement (see

picture 6.3). When you have done all future estimates

(in I-divQ sheet you should make them current year+three

years ahead) for these three (net sales, EBITs and

income statement), you are ready to move along to

the I-main page.

Inputting history figures and changing quarter

As you probably have current prefilled Excel model,

you do not have to update the model by inputting

e.g. quarter figures in past quarters (you only

have to check that they have been inputted correctly

by the analyst whose model you use). However, sooner

or later, as time passes, you have to input also

past quarter-figures. They are inputted in cumulative

section and not in periodic section as estimates.

More

info about changing quarter or year can be found

behind this link.

Updating previous quarter

It is possible that you have received such a prefilled

excel-model where not all historic quarters are

updated. In that case you have to input the old

historical figures. A tutorial for it will be published

later on here. In case you need the instructions

now, please contact

Valuatum.

|

Picture 6.1 - Click picture for

full-size.

Picture 6.2 - Click picture for

full-size.

Picture 6.3 - Click picture for

full-size.

|

7. Long-term estimates

7.1 Background of long term estimates

The basis for the long-term estimates should be the long-term

growth of the sector in general. More

information about all long-term estimates can be found

behind this link.

7.2 Preparing long-term and other estimates

Primary estimate parameters

Right in the beginning of the main sheet you will

find the primary estimate parameters (see Picture

7.1). You have filled some of them (net sales and

EBIT %) already in I-divQ sheet until 2008, but

other estimates should be done here: as you see

from the font colours, they

must not be changed here (otherwise the links would

be destroyed). Many of these figures, like investments/tangible

assets have a big influence on DCF / EVA

fair value, so keep them realistic. Normally you

can make pretty good estimates based on the historic

values. If your companies situation has not changed

significantly, estimates shouldn't do that either.

Secondary estimate parameters and balance sheet

Most of the secondary estimate parameters are connected

to the balance sheet. Again it is natural to keep

things in a certain level. Secondary

estimate parameters inlude working capital items

so e.g. inventory, receivables and non-interest

bearing debt.

Weighted Average Cost of Capital (WACC)

WACC (see Picture 7.2) also is an important factor

in the estimates especially when calculating DCF

/ EVA fair value. Instructions

about the WACC parameters can be found here.

|

Picture 7.1 - Click picture for

full-size.

Picture 7.2 - Click picture for

full-size.

|

8. Analysis is ready - How to put it into the database?

Preparations for your PC

You may have to do couple of things before you

can update your analysis to the database:

i) Setup Java Runtime Environment (JRE) to your

PC (you probably have it already).

ii) Download Valuatum files that are needed to run

the Excel2DB process.

More information

can be found behind this link.

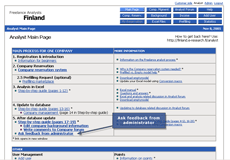

Update analysis to database

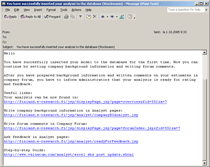

After you have filled the Excel model with your

estimates, you can put it to the database over the

internet with only one click. "Update to the

database" button is located in the main page

(see picture 8.1).

You will receive an email

In this email you will find a link (see picture

8.2). Use this link to open your analysis from the

database. Note that your analysis is not yet shown

anywhere in the freelance analysis pages - You cannot

get there in any other way than using this link.

Use it to open your analysis.

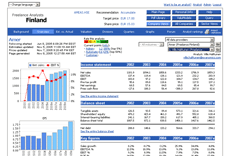

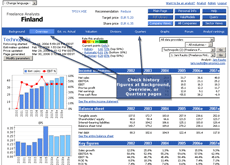

Open your analysis with the link

Now your analysis is in your screen as it would

be shown to a customer (see picture 8.3). You should

check your figures and estimates once more, because

now they are shown in more graphical and illustrative

way. You might also want to think about the valuation

of your share again. When everything is good, move

on to next phases.

Check historical information

Check the historical data. You have probably made

your analysis based on data that other people have

gathered and prepared. Nevertheless, you are responsible

for all the figures in your analysis. This means

you have to check the historical data, especially,

if the old analyst of the company in question (whose

figures you use) is not among the best analysts

according to the admin points. The following figures

are the most important ones and should be checked

by everyone at least for last few years. They can

be found at either Background, Overview, or Quarters

pages in Company views pages in the system. (Picture

8.4)

Number

of shares (Background) Number

of shares (Background)

Net

sales (Overview & Quarters) Net

sales (Overview & Quarters)

EBIT

(Overview & Quarters) EBIT

(Overview & Quarters)

EPS

(Overview & Quarters) EPS

(Overview & Quarters)

Balance

sheet total (Overview) Balance

sheet total (Overview)

If figures are not correct, see Excel

manual.

Att: you can ask us to do first database update

if you encounter any problems

About 5-10% of our analyst encounter some problems

when they try to put their first analysis into the

database. So far all of these problems have been

solved, but in some cases it takes some time to

solve the problems (by us at Valuatum). Thus there

should be some quick way for the analyst to pass

these problems and go on with the analysis.

The solution for this is: if

you encounter any problems then you can always send

the excel-file to

us by e-mail and we put it into the database.

It requires only one press of a button at our side

and thus takes about 5 seconds by us and thus it

is no problem if we have to do this couple of time

on behalf of you. In one case (in 2006 first half)

an Argentinian analyst sent all the excel-models

to us for about 6 months as her own old Portugalian

excel-version did not run our macros. The case was

finally solved so that we send her new excel-licences

|

Picture 8.1 - Click picture for

full-size.

Picture 8.2 - Click picture for

full-size.

Picture 8.3 - Click picture for

full-size.

Picture 8.4 - Click picture for full-size.

|

9. Justifying your estimates

Justify your estimates

Now that you are sure about your estimates and

the reasons behind them, it is time to explain them

to the others. This is extremely important. At this

point it should be clear to you why your estimates

are as they are. Hopefully you followed the instuctions

and took notes already when doing the estimates.

Remember that others cannot read your mind

- If you haven't explained it in the forum, there

is no way people could guess that you have thought

about it when preparing your estimates. And use

graphs along with your comments as

instructed below.

How to write forum comments?

Technically writing messages is very simple. You

can find forum messages below each analysis page.

Just press Write a new message (see Picture 9.1)

and then the message page on the right will open

up (see Picture 9.2).

What kind of message should I write?

Forum messages

should explain and justify your estimates.

To do this you should be able to tell all the relevant

things you have thought about while doing estimates.

You should also tell how your estimate are relative

to management

guidance and to consensus estimates (if available).

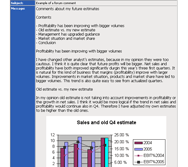

Use graphs

It is recommended to use also graphs with your

forum comments (see Picture 9.3). They make your

text much easier to read and with them it is much

easier to make grounds for your estimates. As you

e.g. describe how the past financial performance

has been and what you have estimated for the future

quarters and years, it is very recommended to use

graphs between your text.

It is very easy to insert graphs from your company

views -pages. And it is also not too difficult

to insert images

from your own.

Look at examples from current top analysts

To get a better picture about forum messages, you

can easily find good examples of them. You can go

Analyst rankings page and see what the top

analysts have done. Press "View"-link

to look at the ones with best admin points and you

should have a good idea what the good messages could

include and look like. Analyst rankings page can

be found behind a link in customer main page. In

upright corner there is a link "All Companies".

Put mouse over it, and new selections will open

up. Choose the last one, Analyst rankings.

|

Picture 9.1 - Click picture for

full-size.

Picture 9.2 - Click picture for

full-size.

Picture 9.3 - Click picture for

full-size.

|

10. Filling in company background info

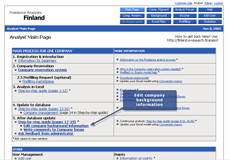

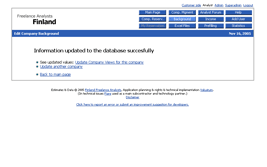

Where should I fill in the background info?

When you see your analysis in the screen, in the

upright corner you see link "analyst".

Choose that and the analyst page will open in front

of you.

Now you can see link called "Edit company

background info" below chapter 5 (see picture

10.1). Choose that and you will come to the page

where you should see your company. There is also

selection between Main information and Financial

bulletin. You have to fill them both.

Financial bulletin is very important for automatic

analysis update watcher: if you have not filled

in the financial bulletin dates (or if your analysis

is unupdated for over one week after some quarter

result) then automatic processes are going to rank

your analysis as "non-current".

Using prefilled background info

You can use already made prefilled background info

that other analysts have filled before you (if there

has been analyst before you).

You can "auto-fill" this information

pressing "Use prefilled values", selecting

the analyst whose information you want to use and

pressing "Prefill fields" (see picture

10.2). All the prefilled information will now appear

to the fields. Remember to check information. It

is likely that some information needs updating.

When the Main information is done, save it by clicking

"Update information" in the end of the

page. By doing so, you will arrive to a page seen

in picture 10.3. You can click Update Company Views

for this company and information will come to your

analysis. You can see the information clicking Background

in the next page.

After this, fill in the Financial bulletin

in a similar way.

A rare situation, when the company hasn't announced

the dates the financial information will be released,

may occure. Then you have to approximate the releasing

date, and make a clear comment in to the backround

page and to the forum that these dates are not announced

by company, but they are approximated by you according

to the information you have. After the company announces

the date, you can update the dates and delete the

comments.

|

Picture 10.1 - Click picture for

full-size.

Picture 10.2 - Click picture for

full-size.

Picture 10.3 - Click picture for

full-size.

|

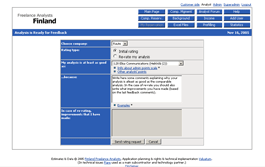

11. Analysis is ready for the public eye - Ask for feedback

Where should I ask for feedback?

You should ask for feedback when your analysis

is ready to be rated. Asking for feedback happens

through Analyst pages (see picture 11.1). There

you will find a link called "Ask for feedback

from administrator". You will arrive to a page

that you can see in picture 11.2.

Asking for feedback

You have now the page on the left in front of you.

First select the company your want to be graded

from the list. Choose initial rating if it is the

first time this company is being rated. Otherwise

choose re-rate my analysis. Then choose a "comparison

analysis": Analysis you think is about the

same quality as your analysis. If you think selecting

one is difficult, just choose one with points you

think you at least deserve. Write some comments

explaining why your analysis is at least as good

as the comparison analysis. In the case of re-rate

you should also write what improvements you have

made (based on the last feedback comments). Do not

ask feedback via email, because it causes difficulties

in the system.

Finally you will receive an email

When your analysis has been rated, you will receive

an email. In this email you will find points you

received, comments about your analysis and improvement

suggestions. There will also be a link, which will

lead you to points page. There you can compare your

points with others.

What does feedback cost?

Your first feedback request will be free but each feedback

request for the same company after

that will cost you 10 euros out of your analyst incomes. More information about feedback request fees

|

Picture 11.1 - Click picture for

full-size.

Picture 11.2 - Click picture for

full-size.

|

12. Continuous analysis (updating numbers and comments)

After the first update and the preparations involved

with it, you do not have to spend much time anymore with

the model itself: it is very fast (couple of minutes)

to

update the historical numbers with each quarter and

it also goes quickly to update the future estimates when

needed.

Most of the time thereafter goes to the most essential

things: Assessing the company´s capabilities, competitive

situation, future demand, changes in environment and how

all these things together shape the future financial performance

of the company. And you should not only think these things

by yourself but put these thoughts to company forum as

arguments for your analysis.

As your analysis becomes good enough, you will start

to get revenues for it. We have written an introduction

on rewarding principles.

You may also find instructions on how

to get the collected rewards paid.

13. Year change and model updating

Finally a few special things that you should remember

in the long-run when you do your analysis:

Year change after annual report

When the company publishes an annual report (usually

in February-March), you should change the year in the

Excel model.

Instructions

for Year change (in Excel manual) Instructions

for Year change (in Excel manual)

Some

background information about Year change (in Product

section) Some

background information about Year change (in Product

section)

Updating your Excel model to the latest version

We continuously update the Excel model and try to make

it better. When you would like to update your model to

the latest version, you can do it with the following instructions:

Instructions

for updating Excel model Instructions

for updating Excel model

Other things

Splits and stock issues must be adjusted in the excel-model.

That is very easy and fast to do (takes about one minute)

if you only know what has to be done in the model:

How

to adjust share splits in the Excel-model How

to adjust share splits in the Excel-model

You can perhaps find help related to starting the analysis

also from:

Advice

for doing estimates and commenting them (Recommended!)

Analyst Main Page (most important

links related to starting the analysis)

Valuatum Excel Model Questions

& Answers

Valuatum Excel Model Manual

(detailed instructions)

Freelance Intro pages

(General info about freelance analysis)

Helping links (Contact

information and links to different pages that you may

find useful)

|